Articles

Aliens that have dual reputation will be find part 6 to have information on the processing an income to possess a dual-condition income tax season. You will want to very first determine whether, to possess taxation objectives, you are a good nonresident alien otherwise a citizen alien. Advance payments of your superior taxation credit might have been made to the health insurer to simply help buy the insurance coverage people, your spouse, or their founded.

When you’re an employee and you found wages at the mercy of U.S. taxation withholding, you need to basically file from the fifteenth day of the fresh next few days immediately after their tax year comes to an end. For individuals who apply for the newest 2024 twelve months, the return is due April 15, 2025. Anyone paid off to arrange taxation statements for others must have a great thorough understanding of taxation matters. For more information on how to decide on a tax preparer, visit Strategies for Opting for a tax Preparer to the Internal revenue service.gov.. Resident aliens could possibly get qualify for taxation pact pros on the things chatted about below. You could potentially generally strategy for withholding taxation smaller otherwise eliminated for the earnings and other earnings which might be entitled to tax pact professionals.

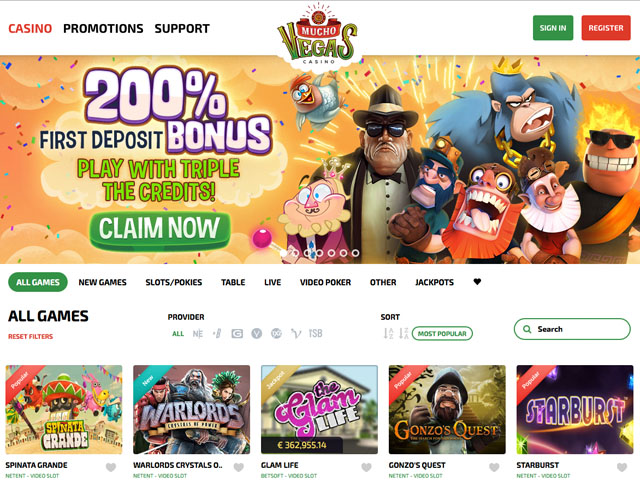

Racing for pinks login uk | Tax Ramifications away from Shelter Places

While you are in another of these kinds and do not have to get a sailing or departure enable, you must be in a position to support racing for pinks login uk their claim to possess exception which have correct identity or supply the expert to your exception. While you are needed to statement the brand new pact advantages but manage perhaps not, you are susceptible to a penalty of $1,000 for each inability. Essentially, the brand new teacher or professor should be in the us mainly to coach, lecture, teach, otherwise take part in research. A hefty part of you to individuals date should be dedicated to those commitments. You happen to be susceptible to a penalty for underpayment away from installments of projected taxation but in certain situations.

Of this $75,one hundred thousand, $twelve,five-hundred ($75,one hundred thousand × 30/180) are U.S. source earnings. When you’re a worker and you can found settlement to own labor otherwise individual characteristics did one another inside and outside the united states, unique legislation implement within the choosing the cause of your own payment. Payment (other than specific perimeter pros) is sourced for the a time basis. Particular perimeter advantages (such as houses and you may degree) try acquired to your a geographic basis. To learn more, discover Real Residents of American Samoa otherwise Puerto Rico inside the part 5. If you are not required to document money, send the fresh statement to the after the address.

John gone back to the us for the Oct 5, 2024, while the a lawful long lasting resident. John turned into a resident before the personal of your third schedule year (2024) beginning after the end out of John’s basic age of household (August 1, 2021). Thus, John try at the mercy of taxation beneath the unique signal to your age of nonresidence (August 2, 2021, as a result of Oct cuatro, 2024) in case it is more than the newest taxation who normally pertain in order to John as the a great nonresident alien. By Oct step one, 2023, Connecticut assets professionals need to return people’ security dumps within 21 months as opposed to thirty days.

$5 Minimal Put Gambling enterprise NZ – Deposit 5 get a hundred free spins

For those who report earnings to the a calendar year base and you also don’t have wages subject to withholding for 2024, document the come back and you will pay your own tax by the June 16, 2025. You need to and make your basic percentage from projected taxation to have 2025 by the Summer 16, 2025. You simply can’t file a mutual tax get back otherwise create shared repayments from projected tax. But not, when you are married to a good You.S. citizen otherwise resident, see Nonresident Spouse Handled while the a resident within the chapter step one. To possess information on how to find the new unique taxation, see Expatriation Taxation, afterwards. You are always involved with a good U.S. change otherwise team when you do private characteristics in the United States.

Tips deposit money with an internet bank

- We’re a financial features platform to own assets executives and citizens.

- When you are in another of these groups plus don’t have to get a cruising or departure permit, you really must be able to help your claim for different that have correct character otherwise supply the authority for the exception.

- You might be capable like to get rid of the money away from real-estate as the effortlessly linked.

You are an enthusiastic LTR if perhaps you were a legal long lasting resident of your own You inside the at the very least 8 of your history 15 taxation decades finish to the 12 months their residency closes. Within the deciding for those who meet up with the 8-12 months demands, don’t number one season you are addressed as the an excellent citizen out of a different nation below a taxation pact and you will manage maybe not waive treaty professionals. This type of regulations implement in order to those people investment development and you may losings from supply in the usa which aren’t efficiently associated with a swap or team in america. It apply even if you are involved with a swap otherwise business in the us. This type of laws do not connect with the newest sale otherwise exchange from a You.S. real-estate focus or even to the brand new sale of every property one to try effortlessly regarding a swap or team from the Joined States.

Shell out U.S. debts away from home

You might deduct their charity benefits otherwise gifts so you can licensed teams susceptible to particular restrictions. Certified groups tend to be teams that will be spiritual, charitable, informative, scientific, or literary in general, or that actually work to quit cruelty to help you pupils otherwise dogs. Certain groups you to give national or global amateur sporting events competition is and qualified organizations. The new deduction to have moving costs is only readily available when you are an associate of the You.S. Armed forces on the productive responsibility and you will, on account of a military acquisition, your move on account of a permanent changes of station. For individuals who qualify, explore Form 3903 to find extent to help you subtract.

Interac and you will Instadebit try each other financial import choices which can be incredibly preferred inside Canada on account of exactly how effortless he’s to make use of. They each link to your finances to cause you to create gambling establishment purchases without lowest, that’s good for investing in brief places. Detachment times are quick also, plus the fees are very sensible due to the quality of solution they provide.

For many who gotten a refund otherwise rebate within the 2024 away from fees your paid in an early 12 months, do not reduce your deduction because of the one to number. Rather, you must through the reimburse otherwise promotion in the earnings if you subtracted the newest fees in the previous year and also the deduction smaller your own taxation. 525 for information on how to figure the amount to provide in the money. Your processing condition is important in determining if you might take certain write-offs and loans. The rules to own determining the submitting position vary to have resident aliens and you can nonresident aliens.

Juan returned to the new Philippines on the December step 1 and you may came back to your You on the December 17, 2024. While in the 2025, Juan are a resident of your United states within the nice visibility attempt. If the Juan helps make the basic-season options, Juan’s residence performing go out would be November step one, 2024.

Shelter deposit laws all of the occupant should know

In addition, it pertains to REMICs that are at the mercy of a yearly $800 income tax. Ca Disclosure Financial obligation – If your fiduciary is involved in a reportable deal, in addition to a great noted transaction, the fresh fiduciary could have a disclosure demands. Install the newest federal Mode 8886, Reportable Transaction Disclosure Report, for the straight back of your own Ca get back in addition to any support dates.